02 Feb

Financial Stress: Your Guide to Navigating Money and The Mind

Let’s talk about something that affects us all: money. More specifically, how it plays a big role in our mental health. Financial stress is no joke, and it can lead to anxiety, depression, and a whole lot of mental health challenges.

We spoke a lot about this topic in one of our podcast episodes: Pocket Perspectives – Money and Mental Health: You’re Not Alone!, so head over and give it a listen, or you can find it on YouTube too! Most of our discussions are summarised in this blog post, so don’t worry if you just want to read about it.

In this blog post, we’re going to dig into the nitty-gritty of how money can affect our minds, and how our mental health can affect our money management. We will share some eye-opening statistics, and give you practical tips and resources to make this journey a little smoother.

Understanding Financial Stress

Coping with Anxiety

Money worries can disrupt our peace of mind, can’t they? When our bank balance isn’t looking too friendly, it can send our anxiety through the roof, leading to excessive financial stress.

It’s like, one minute you’re trying to plan a weekend away, and the next, you’re fretting over whether you can even afford that coffee on the way to work. The future feels like this big, scary question mark, especially when you’re not sure you’ve got enough money to cover the basics.

And let’s talk about debts. It can be exhausting! Managing debts can be a real anxiety trigger, especially when you’re already juggling the stresses of daily life. It’s like you know you have to deal with debts, but the thought of confronting them, or even talking to someone about them, just ramps up the anxiety.

And if you’re someone who struggles with social anxiety, the idea of making calls or meeting with companies you owe money to can feel like a huge mountain to climb.

That’s where IE Hub can help. It’s perfect for those who find the social aspect of debt management daunting. With IE Hub, everything is done online – no need to pick up the phone or have face-to-face conversations. You can handle your debts at your own pace, in your own space, making the whole process feel a lot less overwhelming.

In fact, from one of our customer satisfaction surveys, we discovered that 60% of our users said that their anxiety about other payment plans previously set up, would have been reduced if they could have used IE Hub.

There is then the daily grind: bills popping up here, there, and everywhere. Not only that, the cost of living doesn’t seem to be budging. It’s a lot.

It can turn checking your bank account into a tense moment, make opening bills feel like defusing a bomb, and sometimes, it might even stop you from enjoying the little things.

Dealing with Depression

Dealing with financial worries can be a heavy burden, particularly when you’re also facing the challenges of depression. It’s like being caught in a loop where money struggles keep spinning around, making it feel impossible to break free. This cycle can leave you feeling trapped as if you’re stuck in a never-ending whirlpool of worry and uncertainty.

And let’s talk about the impact on self-esteem. Money problems can be a real confidence shaker. They can make you question your worth and abilities, casting a long shadow over how you see yourself. It’s tough when you start to doubt your capability to manage finances, and this self-doubt can seep into other areas of your life too.

Then there’s the toll on relationships. Financial stress doesn’t just stay in your wallet; it can spill over into your personal life and relationships. Whether it’s with a partner, family, or friends, money worries can add an extra layer of stress, making it harder to maintain healthy, supportive relationships.

Let’s Look at Some Statistics

According to Money and Mental Health.org:

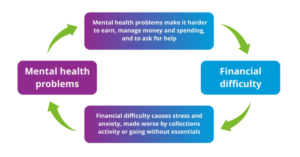

- Over 1.5 million people in England alone are dealing with both money struggles and mental health issues.

- Nearly half of people facing money problems are also wrestling with mental health challenges.

- A whopping 86% say their money situation is making their mental health worse.

- And 70% are feeling like their mental health issues are dragging their finances down.

The image is taken from Money and Mental Health.org and shows the cycle between mental health and financial difficulty.

These numbers are crazy, but of no surprise in the cost of living crisis that we are experiencing today. With so many people struggling, we thought we would share some tips that can help you keep your sanity.

Coping Strategies

Set Realistic Goals – As much as we all want to be debt-free and in a better financial situation, there is no point in setting goals that are out of reach.

Creating a Money Safety Net – Build an emergency fund so unexpected expenses don’t catch you off guard. Check out our blog post which talks all about emergency funds!

Getting Smart with Money – Learn the basics of budgeting, investing, and managing debt, whatever is most appropriate for you. There are plenty of free resources online that can educate you further.

Talk to the Pros – Chat with financial advisors or counsellors for personalised guidance if you think you need it. Citizens Advice is a great place to go for free, impartial advice with money situations.

Deal with your Bills – Let your creditors know your financial situation if you are struggling. Many are open to finding solutions during tough times. Using a service like IE Hub, you can complete your budget and share it with all your creditors, meaning that we do all the work for you. Payment plans can then possibly be set up to help you pay off your debts.

Avoiding the Comparison Game – Remember, your financial journey is unique. No need to compare yourself to others.

Budgeting Made Simple – Create a budget to know where your money is going. It’s like a roadmap for your financial journey. IE Hub’s budgeting tool is perfect for this. It takes you through your whole budget step-by-step so that you can determine exactly what you are earning and what you are spending.

Talk It Out – Share your worries with friends or family. Sometimes, just talking about it can bring relief and solutions.

Self-care – Take care of yourself physically and mentally. Exercise, sleep, and mindfulness can work wonders on stress.

However, all the coping strategies in the world are sometimes not enough, so here are a few places you can go to get that extra help that you need.

Helpful Resources

- StepChange Debt Charity: They offer free debt advice and help create manageable repayment plans.

- The Money Charity: They’re all about financial education, with free workshops, guides, and tools.

- Turn2us: Providing financial support and benefits advice for those facing hardship.

- Shelter: Offering advice on housing-related financial issues, from rent to mortgages.

In a nutshell, handling the connection between money and mental health can be a bit tricky, but it’s doable with the right moves. Don’t hesitate to reach out for help—there are resources ready to support you. Let’s turn that financial stress into a practical roadmap for financial success and a happier, healthier mind!