01 Dec

Credit Score: What is it and Why is it Important?

As a young adult beginning financial independence, it is important to understand your credit score. Your credit score isn’t just a number; it is essentially a passport to financial opportunities. Whether you’re eyeing that dream house, planning to buy a car, or dreaming of your own business, a good credit score can pave the way for these goals.

In this blog, you will learn:

- What credit scores actually are.

- The factors that can affect them.

- Smart strategies to build credit responsibly.

The Basics of a Credit Score

Your credit score is a number that represents how trustworthy you are to take out credit in the future. Scores typically range from 300 to 850, depending on which company calculates it.

This number reflects your borrowing history, financial behaviour, and how good you are to repay debts.

Credit Bureaus

Credit bureaus are companies that gather information about how you use and pay back money you’ve borrowed, like loans and credit cards. They create credit reports, which show your borrowing and repayment history.

These reports are used by lenders (like banks) to decide if they should lend you money or give you a credit card. Remember, if you find mistakes in your report, you can ask the credit bureau to fix them.

Major credit bureaus, such as Equifax, Experian, and TransUnion, calculate your score based on several factors:

-

Payment History 💷 (35%): Payments on credit cards, loans, and bills significantly impact your score. Consistent on-time payments build a positive history, while missed or late payments can drag it down.

-

How You Use Credit 💳 (30%): This refers to the amount of credit you’re using compared to your total available credit. Keeping this low (usually below 30% usage) shows responsible borrowing behaviour.

-

Length of Credit History 🧾 (15%): The longer your credit account is open with little outstanding payments, the better your credit score will be.

-

Credit Mix 🏠 (10%): Having a mix of credit types, such as credit cards, loans, mortgages, can positively impact your score. This shows your ability to handle different forms of credit.

-

New Credit ✨ (10%): Frequent credit enquiries and new accounts in a short span can be perceived as risky behaviour. Aim to space out credit applications to maintain a stable credit profile.

Building Credit Responsibly

There is a huge misconception with credit cards, and other forms of credit, that using them brings debt.

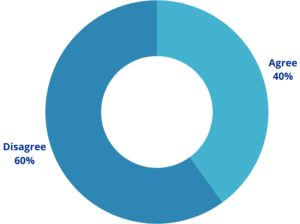

In fact, an IE Hub survey on financial education found that 40% of 18-24 year olds agree with the statement “Credit Cards Bring Debt, so I Don’t Need to Get One”.

This misconception overlooks the potential benefits and responsible uses of credit cards. When used well, credit cards can be tools for building a good credit history. This is crucial for future financial activities like getting a loan for a car or a house.

It’s important to remember that credit cards only lead to debt when they’re used to spend more than you can afford to pay back. By budgeting with tools like IE Hub to track expenses, young adults can take advantage of the benefits while avoiding the pitfalls of debt.

It is very important to understand the difference between using credit to build a good credit score, and getting into unmanageable debt.

Building good credit takes time and patience. Here are some strategies to get you started on the right foot:

-

Get a Starter Credit Card 💳: Consider a secured credit card or a student credit card to kickstart your credit journey. Make small purchases and pay off the balance in full each month. You can use your IE Hub account to create a budget and determine what bills you could put on your credit card. Note, that using IE Hub does not directly affect your score in any way.

-

Pay Bills Promptly ✉️: Whether it’s your phone bill, rent, or utility bills, ensure timely payments. Even a single missed payment can dent your credit score. Having made your IE Hub budget you will know which bills you can afford to pay off.

-

Keep Credit Card Balances Low ⚖️: Maintain a low credit usage ratio by keeping your credit card balances well below the limit.

-

Monitor Your Credit Report 📄: Regularly check your credit report for errors or fraudulent activity. You’re entitled to a free report annually from each of the major credit bureaus.

The Future Benefits of a Good Credit Score

Securing a good credit score isn’t just a box to check; it’s a gateway to financial opportunities. Here’s why it matters:

-

Access to Better Interest Rates 📈: A higher credit score often means lower interest rates on loans, mortgages, and credit cards. This saves you a lot of money in the long run.

-

Approval for Loans and Rentals ✔️: Lenders and landlords often use credit scores to assess risk. A good score can increase your chances of loan approval and sometimes secure better rental terms.

-

Building a Strong Financial Foundation 🏋🏼: A good credit score lays the groundwork for future financial situations. From buying a home to starting a business. This provides you with greater financial flexibility and stability.

In conclusion, mastering your credit score is something you should always consider. Espeically if you are just leaving home and are becoming financially independent. By understanding the factors that influence it and getting used to responsible credit habits early on, you’re setting yourself up for a brighter financial future. Start small, stay on it, and watch your credit score – and your financial opportunities – soar.